On Sunday, consumers gathered to commemorate the death of Peak TV (2013-2023) at SXSW 2024 in Austin, Texas. The presentation, hosted by Variety’s Tyler Acquilina, presented exclusive insights on the latest trends driving media and entertainment, in partnership with Luminate Film & TV.

During these 10 glorious years of this strange and wonderful period in Hollywood history, TV seemed like it could showcase anything, say anything – from a blockbuster prestige drama like Game of Thrones (2011-2019) to a mental health network dramedy such as Crazy Ex-Girlfriend (2015-2019), or even an animated sitcom like Bojack Horseman (2014-2020).

This era, or “peak TV,” s it turned out, portrayed a period of many of the most beloved and well remembered TV shows in Hollywood history – Breaking Bad, Mr. Robot, White Lotus, Dark, Succession, Gilmore Girls, Grey’s Anatomy, and the list goes on and on.

What Killed “Peak TV?”

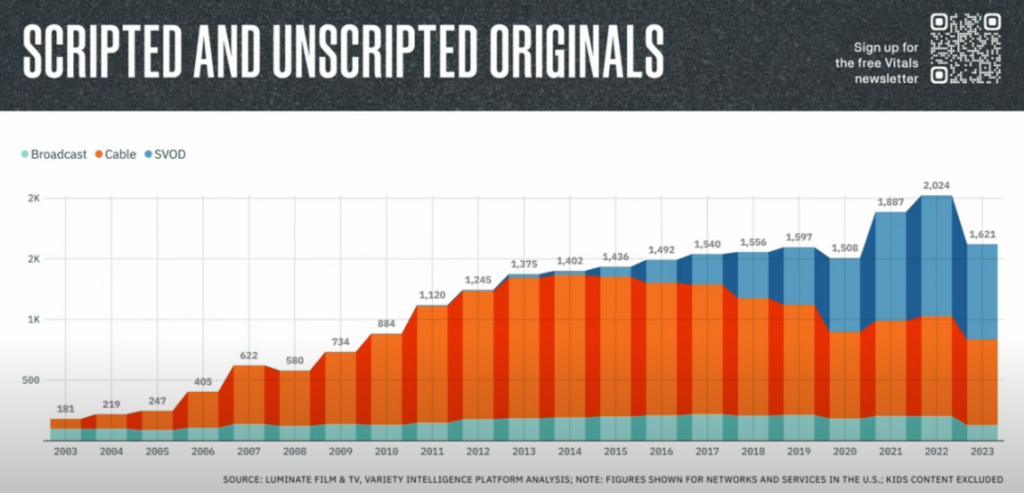

Peak TV can be traced back all the way to the early 2000s, because this is exactly the moment when cable networks realized they could make themselves “more valuable” to viewers and therefore, gain bigger audiences, by creating slates of original programming that viewers wouldn’t be able to find anywhere else.

But why such a massive decline in 2023? Was it the recent writer’s strikes? The streaming wars? Or, as Aquilina presented, “peak TV” itself?

Its “death,” according to Acquilina, happened in two phases – Linear TV and Streaming. As cable was starting to decline, cord cutting began accelerating streaming, which was expanding more and more as people were moving towards Netflix, Prime, and Hulu.

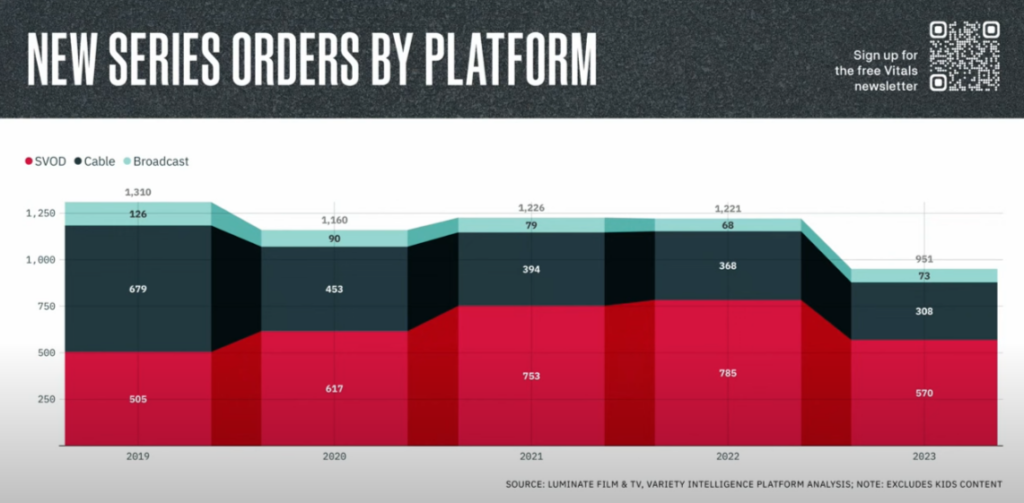

A key factor was the scrutiny on streaming platform finances after Netflix experienced significant subscriber losses in early 2022. This, combined with production slowdowns from the SAG-AFTRA and WGA strikes, contributed to the steepest annual drop in TV output seen in over a decade.

History of Streaming and Impact on TV Industry (150 words)

The rise of streaming in the 2010s accelerated the decline of cable TV and shift to online platforms like Netflix, Hulu, and Amazon Prime. This “streaming wars” period, which we are still currently experiencing, has witnessed massive investment in original content (you can thank Netflix’s House of Cards for kicking that off), fueling unprecedented growth in TV output.

However, the unsustainable costs also increased financial pressures, as seen by Netfllix’s stock crash in late 2022, where industry giants like Disney, Warner Bros., Discovery and Paramount are now facing the ripple effect and scrutiny over these streaming losses. It was during this time that Wall Street investors were paying a lot more attention to how much these companies were spending (and losing) on streaming platforms. With billions of dollars poured into original content in order for platforms to keep up with Netflix, these companies were simultaneously racking up massive deficits in the process.

And where did that land us? Right back where we started – the era of cable TV, which required consumers to subscribe to multiple “channel packages” in order to see specific content they wanted to see. So, did we in fact “cut the cable” or did we simply upgrade it?

HBO kicked off this phenomena as the “gold standard” during the late 90s and into the early 2000s with shows such as The Sopranos, Sex and the City, and Entourage. And in 2008, AMC tipped the scales with its original programming series Mad Men, which became the first basic cable TV show to win the Emmy for “Best Drama Series.”

The early 2010s, however, is where the industry really witnessed this explosion of shows in cable until Netflix came in with its first two and award-winning original series – House of Cards and Orange is the New Black in 2013. And it was 2013 that consumers really “cut the cord,” as it was also the first time that the FCC measured an annual drop in US paid TV subscribers.

After a decade of unprecedented growth in TV output – spanning broadcast, cable, and streaming platforms – 2022, according to data from Illuminate, marked the “peak” year with over 2,000 original titles – followed by a 20% drop in 2023 titles to just under 1,600. Acquilina emphasized that during this peak from 2021 and 2022, there was “never more than a 7% dip,” which he attributed to the writer’s strikes in 2007 and 2008, in addition to the COVID-19 pandemic.

Future of TV – Fewer Shows, Shift to Blockbusters and Unscripted

Acquilina predicted fewer original scripted shows being produced going forward. And we’ve already seen studios prioritizing blockbuster content based on popular IPs to attract the widest possible audiences.

Unscripted and reality content is also expected to grow as a cheaper alternative, while streaming platforms will increasingly rely on licensed library content and international productions from lower-cost regions like India and Africa.

But with fewer options, viewers may face less “choice paralysis” and find it easier to discover something to watch; writers could see more steady seasonal work through a return to longer 20-episode seasons.

Overall, moderating content spending could lead to healthier business models for Hollywood – if done right. Undeniably, a new era of TV is coming, it’s just unclear what that’s exactly going to look like.

One thing that we all can agree on, as Acquilina also acknowledged, is that Hollywood really isn’t a dire place right now, as it works to get its business model back on track. With declining linear TV options, Wall Street isn’t valuing these companies as high as in previous years – but can’t seem to get over this “profitability hump” with streaming.

Could adopting some of these strategies – making fewer shows with broader appeal, perhaps put Hollywood on a path to a healthier business model? It could mean the death of peak TV not having such a mournful occasion after all.

You can watch the full session below: