There are few times as tense as when submitting an insurance claim. Remembering the process and filling out everything just right can be tiresome especially when it is a needed task only once every quarter or less. Knowing that the claim going through will save you thousands of dollars is what makes the process worth it every time. On the flip side if the claim fails to go through it can lead to a feeling of destitution. The reality is that insurance claims are denied every day on valid grounds, improper coverage, and exceptional circumstances but also because of processing errors.

Although there are countless insurance claims and processing errors made every day, it’s these errors that burn out payer employees, frustrate those submitting claims, and often a waste of everyone’s time. Recognizing common denominators in the problem should make the solution easy to strive for. For example, reducing unnecessary errors by using technology can remedy these problems almost instantly.

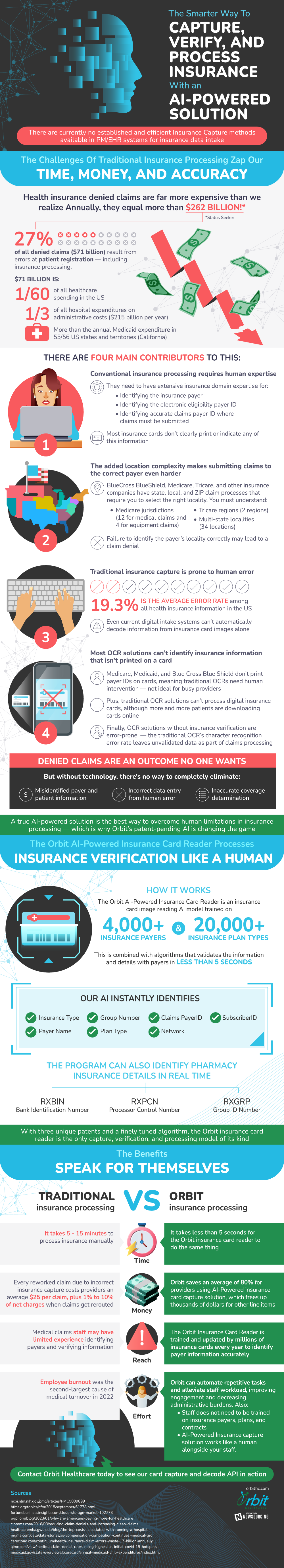

Today, AI-powered insurance card capture and processing is the best tool developed as a means to that end. While digital card readers already exist for insurance cards they are not without flaws. With the help of AI card readers powered by this type of technology are trained explicitly on plans and payers. This gives them the unique ability to actively recognize and process plans themselves.

Having an AI card reader in turn can reduce the amount of monotonous tasks for insurance companies. Additionally, it also reduces the amount of error for claim submitters. And it reduces the amount of expertise required to submit a claim, as now AI can carry part of that process. This is why AI is such an effective tool for reducing frustration and burnout all around. It helps insurance to operate as it should.

Source: OrbitHC